30+ 5 compound interest calculator

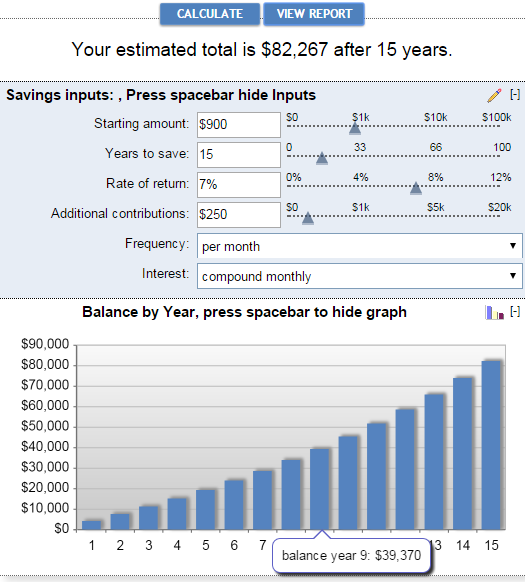

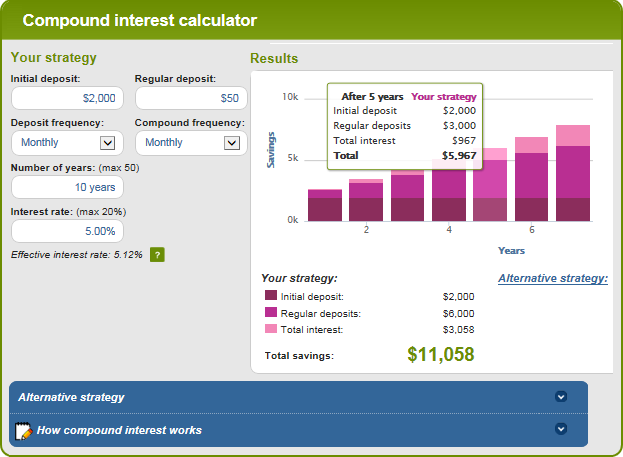

See the difference between daily and annual compounded interest for a 30 investment. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month.

Are You A Real Millionaire 3 Million Is The New 1 Million

Hitting the Calculate button brings up the results of the savings calculator.

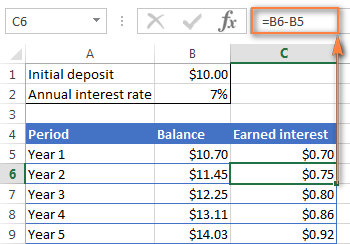

. The compound interest of the second year is calculated based on the balance of 110 instead of the principal of 100. A compound interest calculator helps find the total corpus amount you would earn at the end of your investment period. The compound interest formula is.

Enter the principal amount interest rate and number of years in the respective input field. 30 Compound Interest Calculator. That would be the interest divided by 365 applied every day.

Amount Interest Rate Years to Invest. There are two distinct methods of accumulating interest categorized into simple interest or compound interest. The following is a basic example of how interest works.

How much money will 5 be worth if you let the interest grow. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Where CI Compounded interest.

How much money will 30 be worth if you let the interest grow. Our Resources Can Help You Decide Between Taxable Vs. A P 1rnnt.

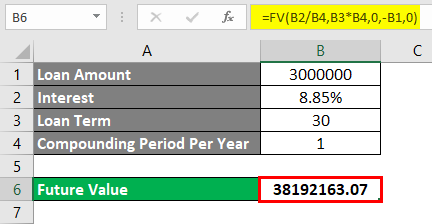

After 30 years the final balance will be 39484. What is the compound interest formula. The 30-year jumbo mortgage rate had a 52-week low of.

The current average interest rate on a 30-year fixed-rate jumbo mortgage is 605 010 up from last week. This time last week it was 593. The procedure to use the compound interest calculator is as follows.

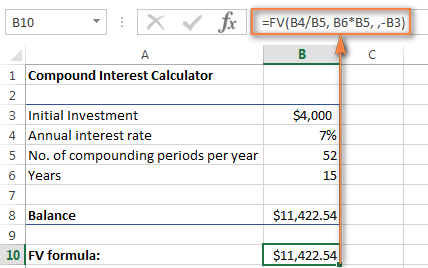

You need to enter the principal amount of investment. Following is the formula for calculating compound interest when time period is specified in years and interest rate in per annum. After investing for 10 years at 5 interest.

APR is the all-in cost of your loan. A P 1 rnnt The compound interest formula solves for the future value of your investment A. 110 10 1.

How the Compound Interest Calculator Works Case Study. Although it is easier to use online daily compound interest calculators all investors should be familiar with the formula because it can help you visualize investing goals. It depends on the interest rate and number of years invested.

At an interest rate of 598 a 30-year fixed mortgage would cost 598. Thus the interest of the second year would come out to. The APR on a 30-year fixed is 599.

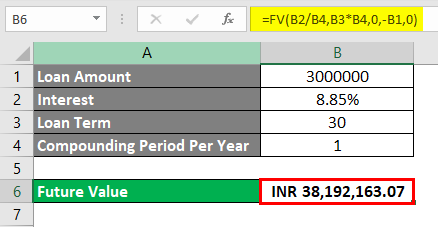

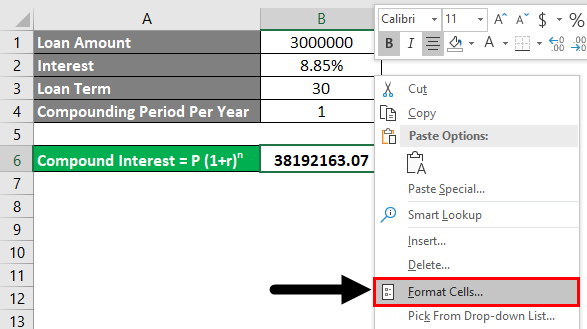

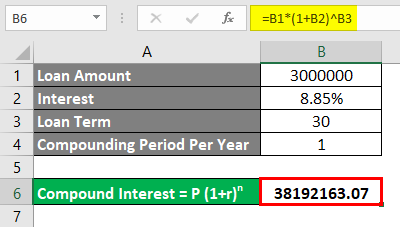

Calculate Compound Interest In Excel How To Calculate

Calculate Compound Interest In Excel How To Calculate

Compound Interest Formula And Calculator For Excel

Compound Interest Formula And Calculator For Excel

Ba 2 Plus Future Contract Price Calculation Continuous Compounding Youtube

5 Financial Goals You Should Achieve By Age 30 Forbes Advisor

The Power Of Compound Effect Investing Money Strategy Money Sense

Compound Interest Formula And Calculator For Excel

100s Of Deck Railing Ideas And Designs Glass Railing Deck Balcony Railing Design Deck Railings

A Loan Of 15 Lacs At 10 Compound Interest Vs Same Amount At 14 Simple Interest Which One Is Better For A Repayment Period Of Ten Years Quora

Pin On For The Home

Calculate Compound Interest In Excel How To Calculate

Compound Interest Formula And Calculator For Excel

How To Save Nearly 7 000 This Year With The 5 A Week Savings Challenge

Calculate Compound Interest In Excel How To Calculate

Calculate Compound Interest In Excel How To Calculate

Pin Auf Hemorrhoids During Pregnancy